- Unit Linked Insurance Plans (ULIPs) are hybrid financial products that combine the benefits of insurance and investment. This article explores the features, benefits, risks, and considerations associated with ULIPs, helping potential investors understand their role in financial planning.

- ULIPs are insurance products that offer policyholders both life insurance coverage and a component of investment. They allocate premiums into various funds (equity, debt, or balanced) chosen by the policyholder, providing the opportunity to participate in the capital markets while securing life insurance coverage.

How ULIPs Work

- Premium Allocation: Policyholders pay premiums, which are allocated into different funds based on their risk appetite and investment goals.

- Fund Options: ULIPs offer various fund options, such as equity funds for higher growth potential, debt funds for stability, or balanced funds for a mix of both.

- Insurance Coverage: ULIPs provide life insurance coverage, with the sum assured paid to the nominee in case of the policyholder’s demise during the policy term.

- Flexibility: Policyholders can switch between different funds or alter premium payment modes (monthly, quarterly, annually) based on changing financial needs.

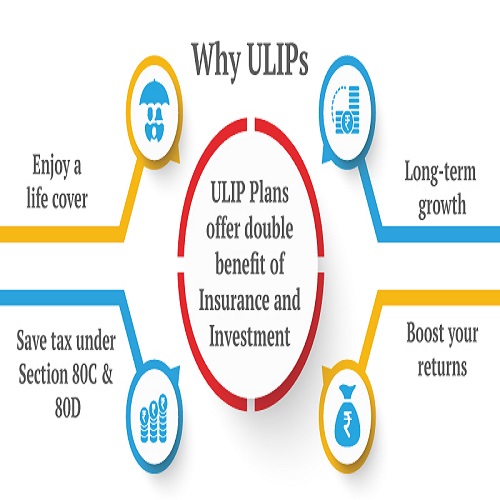

Benefits of ULIPs

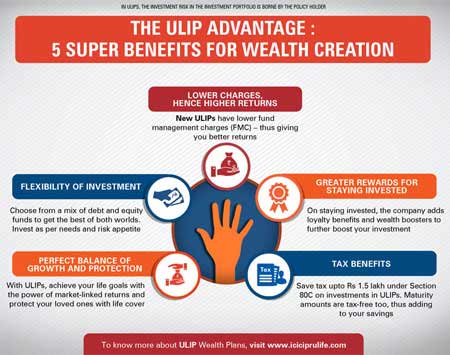

- Dual Benefit: ULIPs combine life insurance protection with investment opportunities, addressing both financial security and wealth creation goals.

- Investment Options: Offers flexibility to choose from equity, debt, or balanced funds based on risk tolerance and investment objectives.

- Tax Benefits: Enjoy tax benefits under Section 80C of the Income Tax Act on premium payments, and tax-free proceeds under Section 10(10D) on maturity or death benefit playout’s.

- Transparency: ULIPs provide transparency in fund performance, charges, and policy features, helping policyholders make informed investment decisions.

Risks and Considerations

- Market Risks: ULIP returns are subject to market fluctuations based on the performance of underlying funds.

- Charges: ULIPs may have charges like premium allocation charges, fund management charges, policy administration charges, and mortality charges, which can impact overall returns.

- Lock-in Period: Typically, ULIPs have a lock-in period of 5 years, during which partial withdrawals or surrender may attract penalties.

- Insurance vs. Investment: Policyholders should evaluate whether the insurance coverage and investment returns meet their financial goals compared to separate insurance and investment products.

Practical Considerations for Investors

- Financial Goals: Align ULIP fund choices with short-term and long-term financial objectives, balancing risk and return expectations.

- Policy Features: Understand policy terms, including charges, surrender options, switching between funds, and implications of discontinuation.

- Performance Review: Monitor fund performance regularly and make adjustments as per changing market conditions or personal financial goals.

Frequently Asked Questions (FAQs)

- What is a ULIP?

A Unit Linked Insurance Plan (ULIP) is an insurance product that combines life insurance coverage with investment options. It allows policyholders to allocate premiums into different funds (equity, debt, or balanced), offering flexibility and potential for wealth creation while providing life insurance protection.

- How do ULIPs work?

- Premium Allocation: Policyholders pay premiums, which are divided into units allocated to chosen funds.

- Investment Options: ULIPs offer various funds (equity, debt, balanced) based on risk appetite and financial goals.

- Insurance Coverage: Provides life insurance coverage with a sum assured paid to nominees in case of the policyholder’s demise.

- Flexibility: Allows switching between funds and adjusting premium payment modes based on financial needs.

- What are the benefits of investing in ULIPs?

- Dual Benefits: ULIPs offer both life insurance protection and investment opportunities under a single plan.

- Flexibility: Policyholders can choose funds based on risk tolerance and financial goals.

- Tax Benefits: Enjoy tax deductions under Section 80C on premiums paid and tax-free proceeds under Section 10(10D) on maturity or death benefits.

- Transparency: Provides transparency in fund performance, charges, and policy features.

- What are the charges associated with ULIPs?

ULIPs may include various charges such as:

- Premium Allocation Charges: Deducted upfront from premiums.

- Fund Management Charges: For managing the investment funds.

- Policy Administration Charges: For administrative expenses.

- Mortality Charges: Covering the cost of life insurance.

- What are the risks involved in ULIPs?

- Market Risks: Returns are subject to market fluctuations affecting fund performance.

- Charges Impact: High charges can reduce overall returns.

- Surrender Charges: Levied on early withdrawals or policy discontinuation.

- Insurance and Investment Risks: Balancing both aspects (insurance and investment) to meet financial goals effectively.

Start SIP with Zero Charges and Make 1 Crore : Start Stock SIP Today

- Can I switch between funds in ULIPs?

Yes, ULIPs offer flexibility to switch between different funds (equity, debt, balanced) based on changing market conditions or personal risk appetite. Some plans may have limits on the number of free switches per year.

- What happens if I stop paying premiums in ULIPs?

If premiums are discontinued, the policy may lapse or become paid-up depending on the accumulated fund value and policy terms. Surrendering a ULIP before the lock-in period may attract penalties.

- How long is the lock-in period for ULIPs?

ULIPs typically have a lock-in period of 5 years, during which partial withdrawals or surrender may not be allowed without penalties. This lock-in period encourages long-term investment planning.